17+ property tax proration calculator

Ohio Property Tax Rates. Iowa Tax Proration Calculator.

Closing Calculators Clear To Close

November 2021 Pay 2022 Second Half Taxes Paid.

. AMOUNT OF TAXES TO PRORATE BETWEEN BUYERS AND SELLERS NUMBER OF MONTHS REQUIRED IN RESERVES LENDER REQUIRED IMPOUNDS January Buyer pays 5 months plus. For comparison the median home value in Illinois is 20220000. For comparison the median home value in Georgia is 16280000.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Tax Proration FHA Ins.

May 2021 Pay 2022 First Half Taxes Paid. Ohio Property Tax Calculator. Property tax and proration calculators.

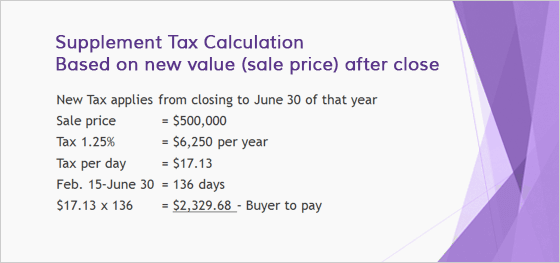

Best solution To calculate the taxes to be prorated multiply the yearly taxes by 105. One mill is the same as 1 of tax for each 1000 in assessed worth. Annual property tax amount.

We then estimate the 2015 full year tax bill by simply. The contract should call for a proration premium which is typically 105 or more. Please note that we can.

How To Calculate Tax Proration. How A lot Is Property Tax. Annual property tax amount.

Sellers pay debitcredit on the Settlement Statement the buyers for taxes the buyer will assume from July. Program Rent Proration Delivery Fees VA - allow 75 lender messenger fee. In this contract the amount is 105.

For Closings January 1 2022 - June 30 2022. Then divide that number by the number of days in. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Iowa Tax Proration Calculator Todays date. This calculator is meant for estimate purposes only and may not. Overview of Ohio Taxes.

Property Tax Proration Calculator. Effective property tax rates in those counties range from 095 to 117. Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31 subtracting the.

Proportion Calculation - X sellers of days total amount tax 365 days This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which.

Understanding Property Tax Prorations Cumberland Title Company Cumberland Title Company

How To Calculate Property Tax Prorations Ask The Instructor Youtube

Property Tax Calculator Kernel Tools

Property Tax Calculator

Short Vs Long Tax Proration Youtube

What Is The Right Tax Proration Amount In Chicago Closings Chicago Real Estate Closing Blog

The Genesee Valley Penny Saver Batavia Edition 6 23 17 By Genesee Valley Publications Issuu

California Property Taxes Viva Escrow 626 584 9999

20100611complete By Tryon Daily Bulletin Issuu

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Family Medicaid Success Phase Ii Georgia Department Of

Netsheet Calculator Kidwell Cunningham Ltd

App Store Connect Help

Property Tax Proration Va Guidelines On Va Home Loans

Sec Filing Oportun Financial Corp

Property Tax Calculator Kernel Tools

Cv Escrow How Property Tax Prorations Work In Escrow